Monday, October 3, 2011

Tuesday, September 6, 2011

Economy: We Are in 'Worse Situation' Than in 2008, Says Nouriel Roubini - CNBC

The world’s developed economies are trapped at the “stall speed” of low growth and need to have greater fiscal stimulus and less austerity to kick-start growth, leading economist Nouriel Roubini told CNBC Friday.

Speaking at the Ambrosetti Forum on the shores of Lake Como, near Milan, Roubini said in an interview: “We are in a worse situation than we were in 2008. This time around we have fiscal austerity and banks that are being cautious.”

Roubini, known for his bearish views on the world economy, thinks that there is a 60 percent chance of a second recession imminently. Economic data of recent weeks presents a mixed picture.

On Thursday, the US government announced that jobless claims dropped by 11,000 to 409,000 last week. Friday's employment report in the US is expected to show a gain of only 75,000 nonfarm jobs during August, with the unemployment rate steady at 9.1 percent.

Recent surveys point to slumping business and consumer confidence across the developed world.Asked if there was still a chance the developed economies could avoid recession, Roubini said: "That’s very optimistic if you look at the data."

"The hard economic data (which has come out recently) is all relevant to July while the soft data which has come out is for the future and that’s all moving in the wrong direction," he added.

He also believes that a third round of quantitative easing in the US may not have the desired long-term effects, and that further fiscal stimulus across Europe and the US will be needed.

Economy: We Are in 'Worse Situation' Than in 2008, Says Nouriel Roubini - CNBC

Tuesday, May 10, 2011

Sunday, January 31, 2010

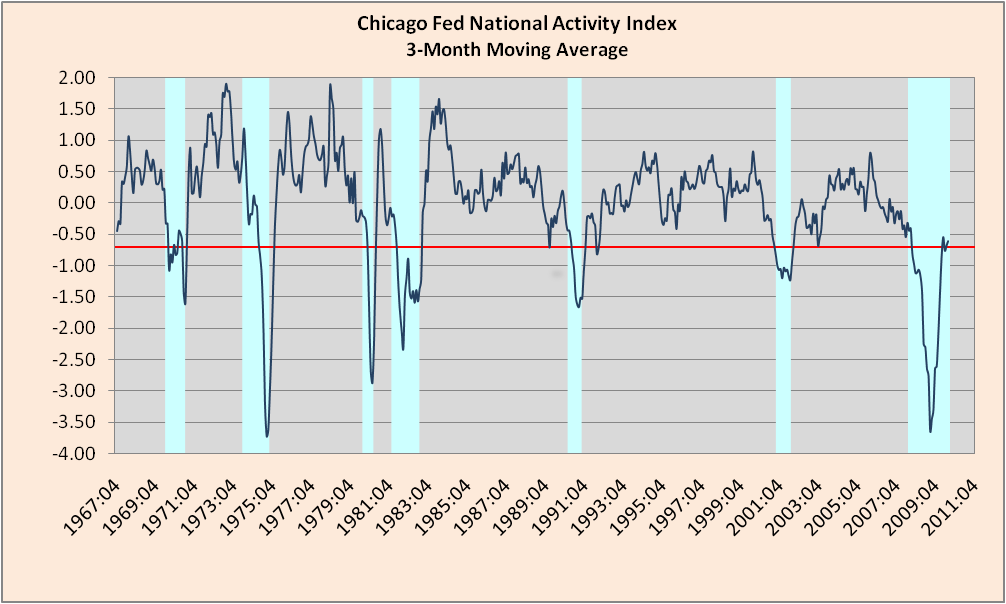

Best Economic Gauge You’ve Never Heard Of

While everyone awaits GDP data this morning, why don’t we look at the best economic gauge you have never heard of:

It doesn’t appear on any economic calendars that I’m aware of. It flies under just about everyone’s radar. Technically, it’s not a data point itself but a weighted amalgam of 85 other distinct economic data points, an all-in-one look at the United States economy.

And it does an excellent job of tracking the economy’s health.

It’s the Chicago Fed’s National Activity Index (CFNAI), and it just printed for December.

Say the folks in Chicago:

The CFNAI is a weighted average of 85 existing monthly indicators(pdf) of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend.

The 85 economic indicators that are included in the CFNAI are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories. Each of these data series measures some aspect of overall macroeconomic activity. The derived index provides a single, summary measure of a factor common to these national economic data.

Additionally, they advise us to focus on the three month moving average:

Month-to-month movements can be volatile, so the index’s three-month moving average, the CFNAI-MA3, provides a more consistent picture of national economic growth.

When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun.

When the CFNAI-MA3 value moves above +0.70 more than two years into an economic expansion, there is an increasing likelihood that a period of sustained increasing inflation has begun.

That said, here’s the chart:

Source: Chicago Fed

>

The MA3 has stalled since hitting -0.54 in September, recording -0.76, -0.68, and now -0.61 since then. We’ve gotten the bungee bounce off the economic and market lows of almost one year ago. The question now — as I’ve been opining for quite some time — is to sustainability. We’re clearly faltering, with nary a green shoot in sight (witness the just-released Durable Goods orders and weekly Unemployment Claims, which were both weaker than expected). Lots of interesting numbers coming out over the next week, culminating with Friday’s jobs report. The stock market is, perhaps, starting to recognize the loss of momentum.

Interesting times . . .

Thursday, November 5, 2009

It is Japan we should be worrying about, not America- More Doom and Gloom

Japan is drifting helplessly towards a dramatic fiscal crisis. For 20 years the world's second-largest economy has been able to borrow cheaply from a captive bond market, feeding its addiction to Keynesian deficit spending – and allowing it to push public debt beyond the point of no return.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/6480289/It-is-Japan-we-should-be-worrying-about-not-America.html

The more economics and financial articles I read the more I feel like we are hurtling towards certain disaster. But the really big problem is that we have inept politicians who don't understand anything about business or economics in charge of our futures. Its going to be a really bumpy ride over the next ten years.